Uniswap Wikipedia

If or not you’lso are an amateur otherwise a professional DeFi trader, studying Uniswap is an option part of navigating the industry of decentralized finance (DeFi). In case your speed movements external their put diversity, their exchangeability was centered on the among the possessions and you may end generating charges. You can lay a particular diversity or offer exchangeability across the full budget. Concurrently, Uniswap v3 has become on the brand new Optimistic Ethereum system. Covering two scaling alternatives try vastly far better than coating one to scaling possibilities.

Uniswap exchange – Utilizing the newest Uniswap process

Uniswap offers a simple program and you may several cryptocurrencies, therefore it is probably one Uniswap exchange of the most preferred DEX available today. Uniswap will not render exchangeability to possess tokens however, utilizes profiles to become listed on and delegate their possessions to liquidity swimming pools. Uniswap allows users to create the swimming pools, usually a combining away from digital property, including USDC/ETH. Users deposit a similar level of for every money and certainly will earn transaction fees whenever the pond can be used so you can processes an exchange. Uniswap also offers entry to more 600 Ethereum-based cryptocurrencies to trading, and a great blockchain connection to the Polygon system in order to trade Polygon-founded crypto.

County of Crypto: Shutdown View

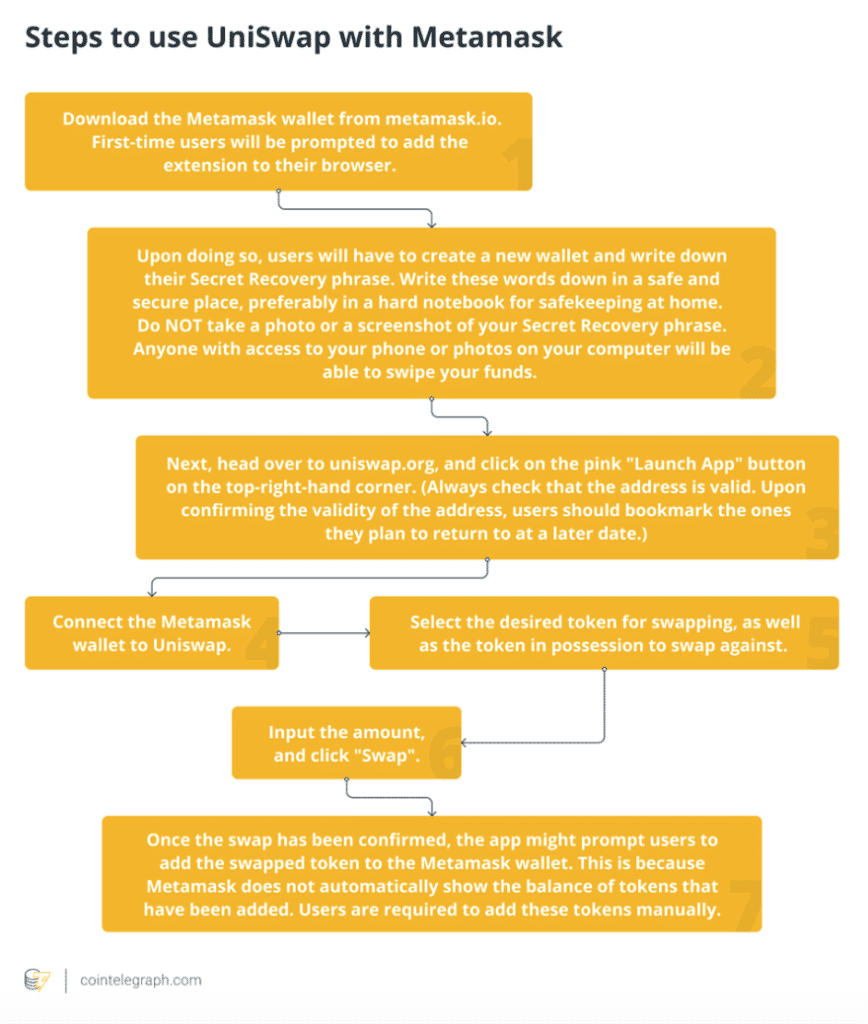

Immediately after looking your bank account, hit “Second,” next mouse click “Confirm” to provide Uniswap the necessary permissions. Following software reveals, find the brand new “Connect” button regarding the best correct corner. Mouse click they and select the new wallet your’d desire to fool around with (we’ll have fun with MetaMask such as). When you’lso are indeed there, you’ll see a “Release Software” switch in the finest best area.

To give change fees, Uniswap allows profiles to replace tokens to your Polygon network or make use of the Optimism of Arbitrum links. Because of the integrating with our networks, Uniswap buyers can also be down an excessive amount of gas system charge while in the peak volatility. Users may also check out the better pools (from the overall value locked) and include liquidity for the current pool. Higher-regularity pools will pay away with greater regularity, while the pool have a tendency to process a lot more deals than quicker pools. Profiles can also be change Ethereum-based gold coins otherwise fool around with one of many links to help you change tokens that use most other protocols. With over 600+ tokens to select from rather than membership registration or KYC processes, Uniswap is an excellent selection for trading tokens anonymously to the an easy-to-explore program.

Plunge for the arena of DeFi programs, integrations, and you may developer tooling built on the upper Uniswap Method. To begin with, we want to clarify the differences amongst the additional aspects of “Uniswap”, many of which will get mistake new users. Since the structure continues to develop, DeFi may also help the newest U.S. lead in framing next day and age from money, rooted inside openness, transparency, and you can options.

To simply help find people discover vulnerabilities, a public insect bounty is going to run along the 2nd 30 days, with to $five hundred,100 considering for important insects. We thinks protection is very important — they grabbed hundreds or even thousands of hours from analysis for us to feel more comfortable with launching Uniswap v3. Uniswap v3 also provides tall developments to your TWAP oracle, where you can determine any current TWAP in the last ~9 weeks in one on the-strings call. That is achieved by storage space an array of collective amounts rather of just one. V3’s LP customizability opens a book purchase ability to suit business sales, and therefore our company is getting in touch with “variety purchases”.

Join all of us in the creating thefuture from finance

Among the differences when considering both DEXs would be the charges you to exchangeability organization is actually energized. You will find a 0.3% render away from Uniswap, a great 0.25% provide away from SushiSwap, and you will a supplementary 0.05% dividend paid off to owners of SUSHI tokens. As well as nonfungible tokens, Uniswap have disclosed centered exchangeability ranking. Despite a number of limited variations, both programs are very comparable. And also being entirely unlock resource, Uniswap in addition to enables people to do its decentralized exchange based on Uniswap’s password. UNI ‘s the governance token of your own Uniswap protocol, permitting people to participate the fresh platform’s decentralized governance.

The newest code has been assessed rigorously, along with a $dos.35M shelter battle work with by Uniswap Laboratories, Uniswap Basis, Certora, and you will Cantina. To your regarding hooks, you can now perform the brand new form of industry formations, more possessions, and you will the brand new abilities in addition Uniswap Protocol. To begin with having fun with Uniswap, you’ll want to hook the bag on the platform. Uniswap supports a variety of wallets, such as the Uniswap Bag, Metamask, Coinbase Bag, and you will WalletConnect. It is one of the most preferred ways to replace with the newest Uniswap Process. All of us has thorough theoretic and you can practical experience inside exchange, cryptocurrencies, and you will blockchain.

As an alternative, playing with a centralized exchange that have strong liquidity around the its change sets would be a far greater choice. For example, Binance also provides a maximum trading payment away from 0.1% for each trade. In return for putting up their funds, for each LP obtains a token one is short for the new bet contribution in order to the new pond. Such as, for many who provided $10,100000 to help you an exchangeability pond one to stored $one hundred,000 overall, you might discovered a great token to have 10% of that pond. Uniswap charges profiles an apartment 0.30% payment for each exchange that happens to your platform and you may immediately directs it to help you an exchangeability put aside. Exchange seamlessly across Ethereum, Polygon, Arbitrum, and you may Optimism with Uniswap’s unlock-supply mobile purse software.

Bitcoin Development: Chinese Company Tends to make $1 Crypto Bet

Inside the Uniswap v3, LP’s can also be concentrate their investment within this custom prices, delivering higher levels of liquidity during the wished cost. In the doing this, LPs construct individualized rate contours one mirror their own choices. To own a deeper technology review read the Uniswap v3 Core whitepaper, the new Uniswap v3 Center wise contracts. Hooks make it builders to create custom reason for how swimming pools, exchanges, fees, and you may LP ranks interact.

- Once you’ve among those purses, you need to put ether so you can they before you can trading to your Uniswap otherwise pay for gasoline, what are the Ethereum transaction can cost you.

- Users from Uniswap in addition need ether (ETH) to pay one deal costs.

- The following way to profit on the DEX would be to end up being an exchangeability merchant.

- Which is when Hayden Adams, the brand new blogger from Uniswap, shown the newest Uniswap within the second half of 2018.

- Users change from the mutual liquidity of all the private contours which have zero energy rates improve for each liquidity vendor.

The brand new Uniswap blockchain is obviously upgraded on the newest trade advice out of pages. And, naturally, it is an automatic field founder because it doesn’t you need people assistance from a central authority. Giving crypto possessions to your Uniswap is an easy solution to import tokens from a single wallet to another. If you’re spending someone or moving property between your individual wallets, Uniswap makes it easy. Uniswap is a great applicant to own investigating decentralized to the-chain bucks moves.

In exchange for taking liquidity, LPs earn exchange charges created by the fresh pool. Anyone can become a liquidity vendor, a transformative switch to participating in monetary places. Instead of traditional transfers, decentralized transfers is actually unique while they ensure it is pages so you can swap tokens as opposed to businesses assisting the transaction otherwise taking command over finance. Swapping to the Uniswap is completely mind-custodial, you constantly maintain power over their possessions — and no 3rd party takes or misuse their fund. Uniswap is among the biggest Ethereum blockchain-founded decentralized exchanges (or DEX). It permits pages around the world to exchange cryptocurrencies individually.